Latest Articles

FIBRA Prime: Leading the Transformation of Peru’s Real Estate Market with a Sustainable, Strategic Vision

Fixed Income Investors Favor REITs’ Strong Disclosure, Resilience Amid Limited Supply

Apple Hospitality’s Select Service Focus Core to Success Across Multiple Cycles

CubeSmart Crafts Personalized Approach to Employee & Customer Engagement

Data Centers: Best-in-Class Operators with Strong Demand and Operational Performance

Names to Note: June 2025

Industrial REITs Positioned for Growth Once Uncertainty Clears

AI Industry’s Office Space Demands Creating Strong Tailwinds for REITs

Looking to search all news?

With industry news, monthly market updates and more, we’ve got you covered for all things REIT. Search our extensive database to find interviews, blog posts, articles, videos and podcasts.

Market Commentary

View all Market CommentariesREIT Report Podcasts

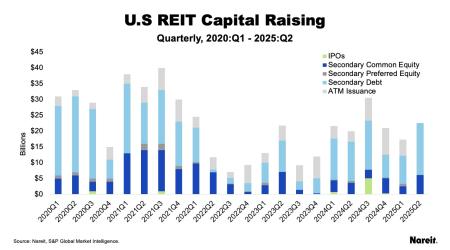

Mid-Year Update: REITs Weather Volatility, Positioned for Growth

REITs and AI: How to Harness AI to Ensure Longevity & Continued Sector Leadership

Russell Investments on Using REITs to Access Modern Economy Real Estate

Kimco CEO Conor Flynn on the Continuing Evolution of the Open-Air Shopping Center

Chilton’s Matt Werner on Benefits of an Active REIT Strategy in Volatile Markets

PwC’s Tim Bodner Sees “Fairly Robust” Transaction Activity Across REIT Sectors

Sila Realty Trust CEO Sees Opportunity to Scale Growth with High Quality Assets

The Human Impact of Extreme Weather Events

Nareit Developments

View all Nareit DevelopmentsLatest Videos

Japan Metropolitan Fund Shifts Strategy to Embrace Rental Growth

Global Net Lease CEO Says Disposing of Shopping Center Assets Accelerates Strategic Plans

CareTrust REIT CEO Says Expansion into UK Market “Transformative” for REIT

Phillips Edison Emphasizes Stability and Innovation Amid Market Shifts

Summit Hotel Properties CEO Sees Travel as Long-Term Secular Growth Industry

Easterly Sees Opportunity as Government Prioritizes Real Estate Efficiency

Veris Residential CEO Sees Jersey City Demand Driven by Manhattan Spillover