More Institutional Investors Will Likely Use REITs for Portfolio Completion

Key Takeaways

- The divergence in REIT and private real estate valuations will continue to offer a compelling tactical opportunity.

- Institutional investors will continue to use REITs as part of portfolio completion strategies to gain geographic or sector diversification.

- Looking forward, investors may use REITs to help achieve their sustainability targets.

Increasingly, institutional investors are recognizing that REITs provide both tactical and strategic opportunities and should be included in their real estate portfolios. Tactically, in the current macroeconomic climate, REITs provide an opportunity to take advantage of the large valuation gap between REITs and private real estate—a gap that will likely close during 2024. Strategically, REITs offer geographic and sector diversification and can enhance a portfolio’s sustainability attributes—all of which will entice more institutional investors to use REITs as part of portfolio completion strategies in 2024.

Institutional Investors’ Current Use of REITs

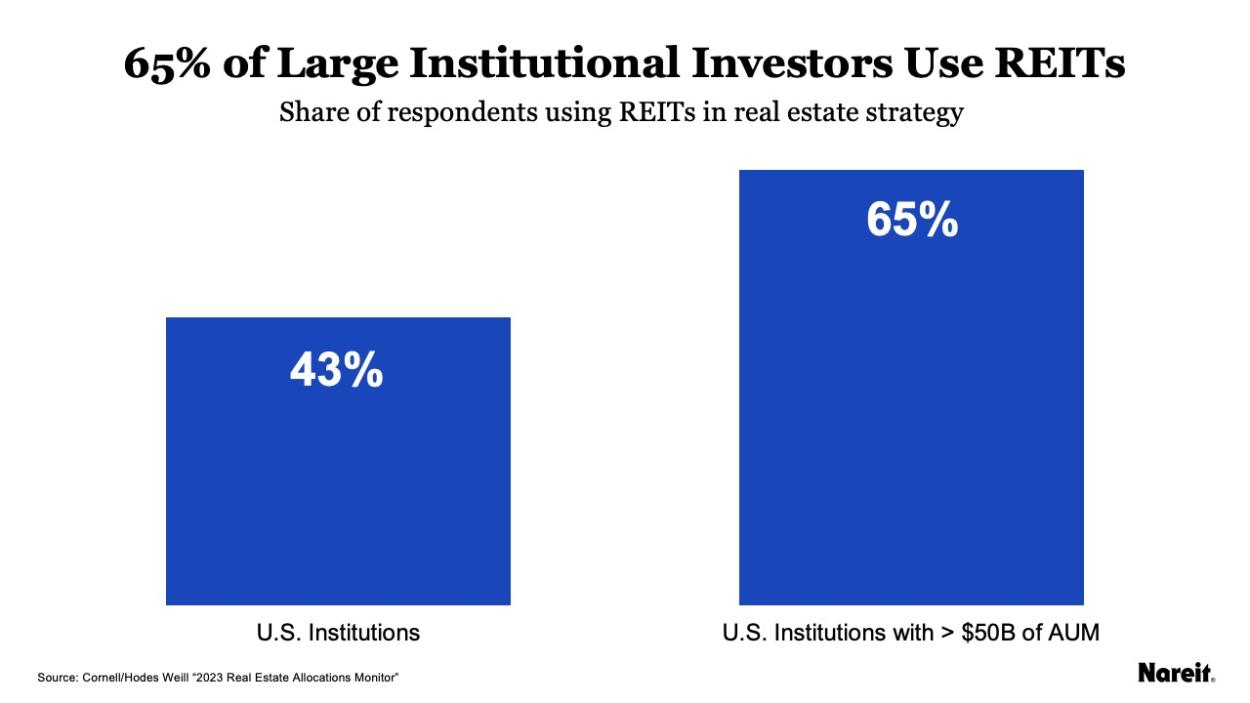

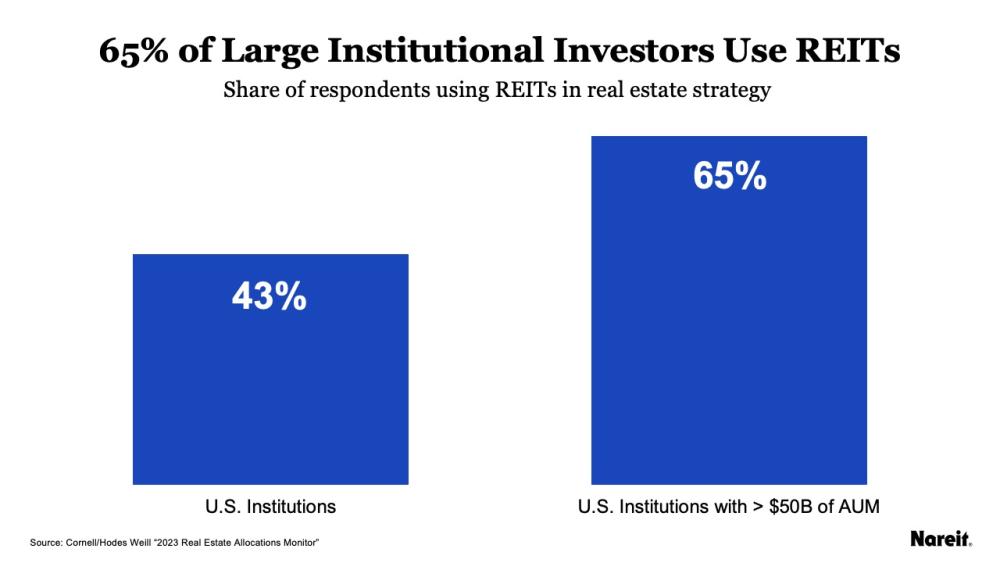

Nearly two-thirds of the largest and most sophisticated U.S. institutional real estate investors use REITs in their real estate strategies.

According to the Hodes Weill & Associates and Cornell University 2023 Real Estate Allocations Monitor, institutional investors view REITs as a complement to private real estate in overall portfolios because REITs fulfill their allocation needs and address liquidity objectives. The joint report surveyed 175 institutions across 25 countries. As shown in the chart above, 43% of U.S. investors surveyed use REITs in their real estate strategy; and when looking at the largest and most sophisticated U.S. institutions, 65% of those surveyed use REITs.

Institutional Investors’ Use of REITs Will Grow

In 2024, we expect to see more institutional investors that desire using REITs as part of portfolio completion strategies, or in a key investment role to optimize, or complete, an aspect of a real estate portfolio.

For example, institutional investors that desire greater geographic diversification, can add non-U.S. REITs and listed real estate to their portfolios. Likewise, investors that want more exposure to sectors that drive the modern economy, like data centers and telecommunications, institutional investors will use REITs to gain exposure to those sectors because REITs have larger portfolios and deeper operating platforms and experience than most private real estate funds. Finally, investors that have sustainability as part of their investment objectives will turn to REITs for their best-in-class environmental, social, and governance attributes.

In 2024, we expect to see more institutional investors using REITs as part of portfolio completion strategies, or in a key investment role to optimize, or complete, an aspect of a real estate portfolio.

Case Studies Show Innovative Approaches to Using REITs

Throughout 2023, Nareit published case studies showing how institutional investors are using REITs to meet their real estate portfolio objectives by increasing property sector diversification and boosting returns. These case studies serve as examples for other institutional investors who wish to use REITs in 2024.

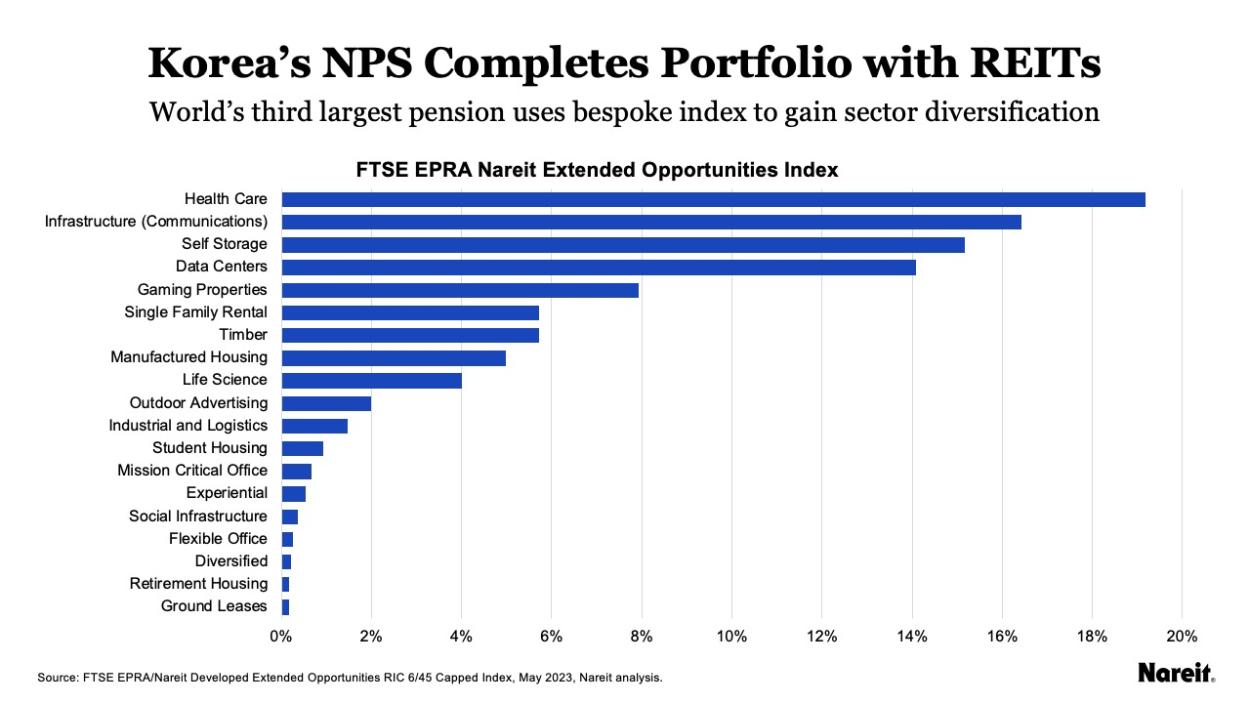

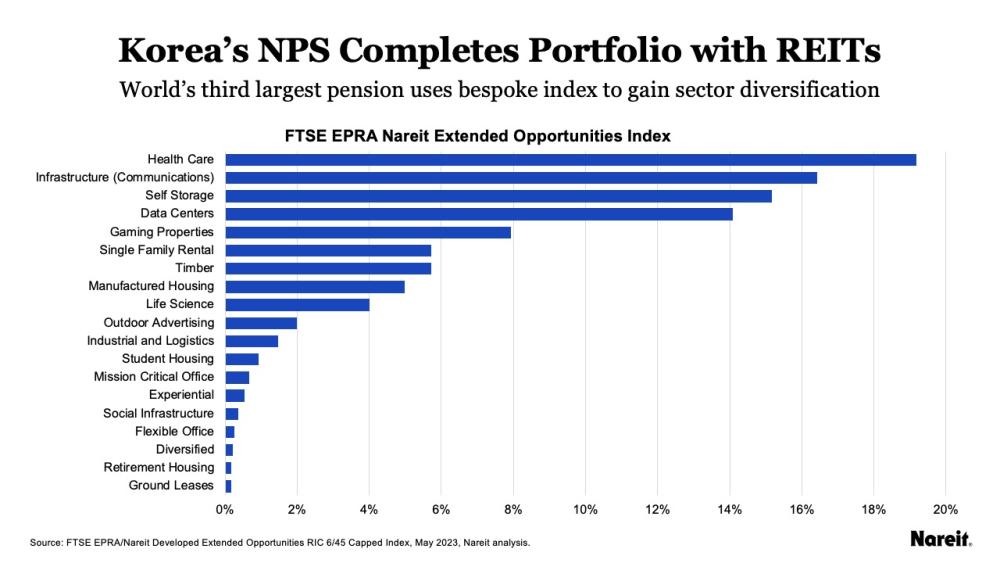

South Korea’s National Pension Service (NPS): Working with the European Public Real Estate Association (EPRA) and FTSE, Nareit helped design a new index that targets property sectors that NPS does not own. NPS is benchmarking an initial $1 billion against this new index to complement its large private real estate portfolio.

NPS’ portfolio completion strategy focuses on new and emerging sectors and unique strategies within traditional sectors.

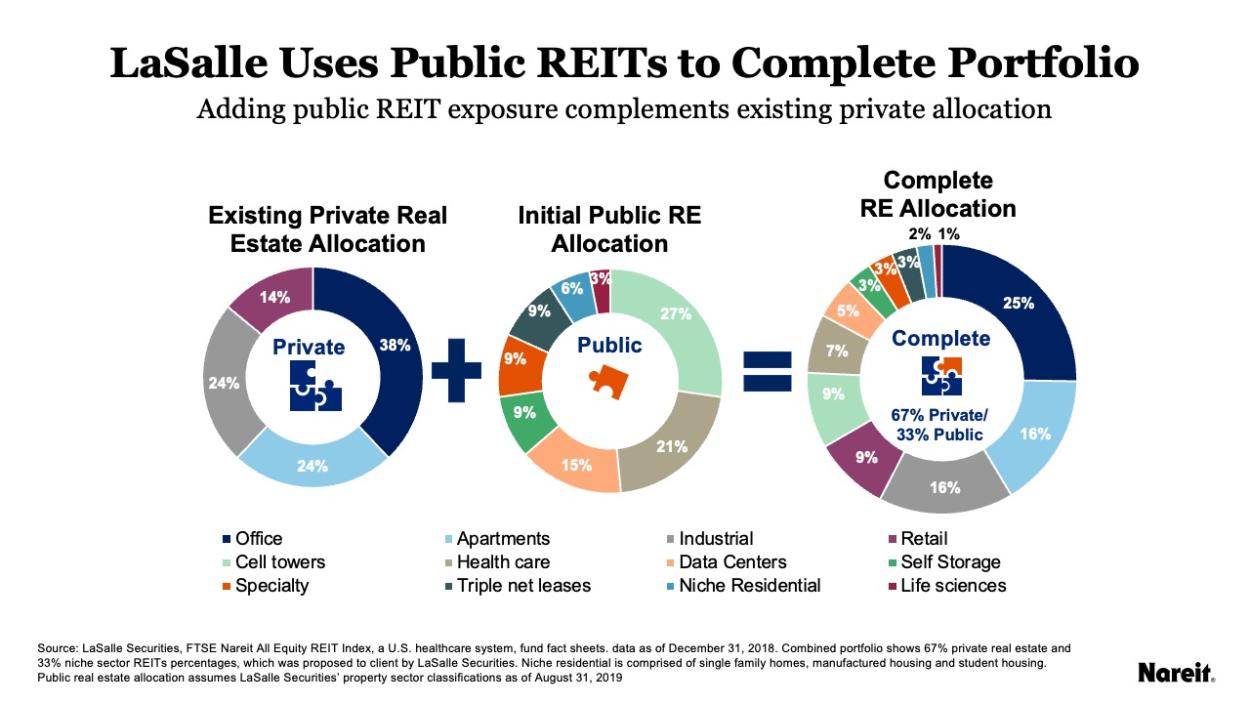

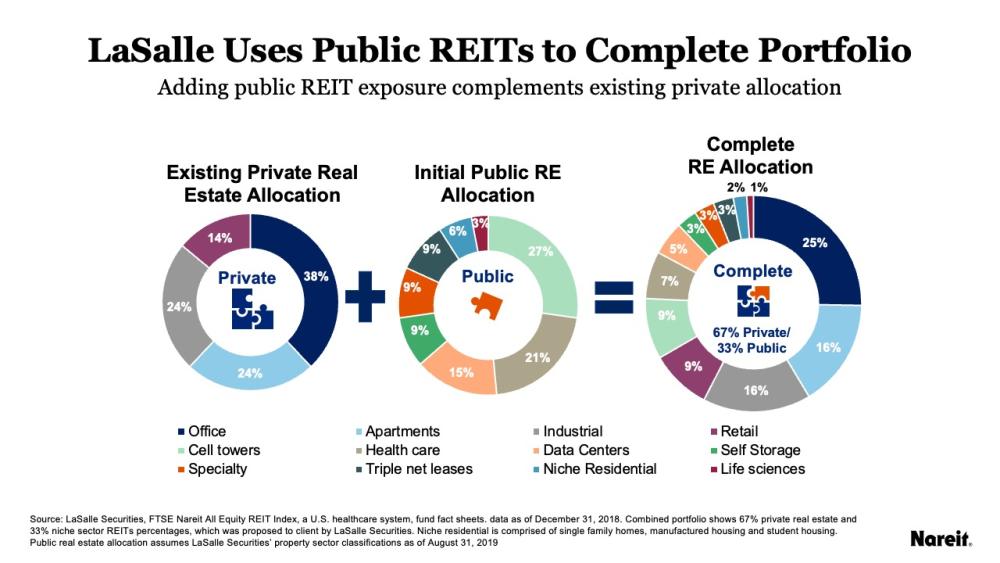

LaSalle Securities: Investment management firm LaSalle Securities successfully used a portfolio of REITs to dramatically change the composition of the real estate allocation for a moderate sized health care pension system. The LaSalle Securities team collaborated with the client to map the allocation of their existing real estate portfolio, identify the gaps, and then identify a selection of REITs the client could invest in to address those gaps.

The chart above illustrates how the REIT strategy successfully changed the client’s real estate portfolio by adding a listed REIT allocation to new and emerging property sectors to complete the portfolio.

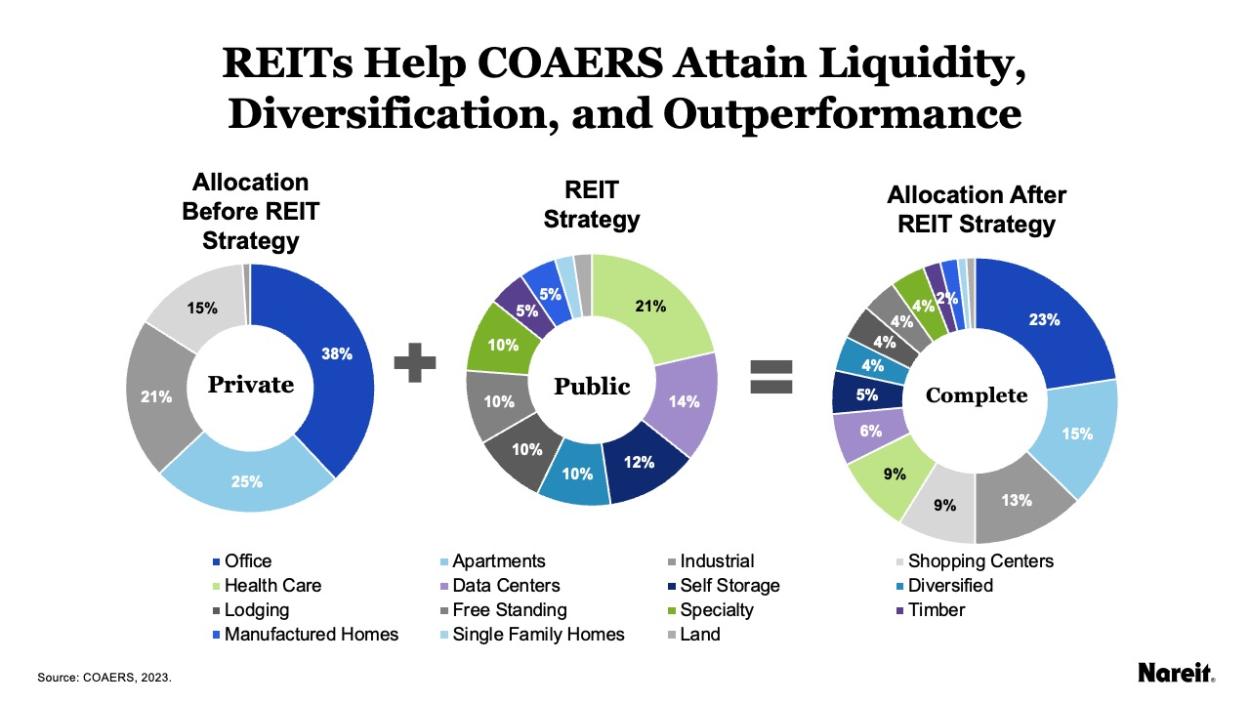

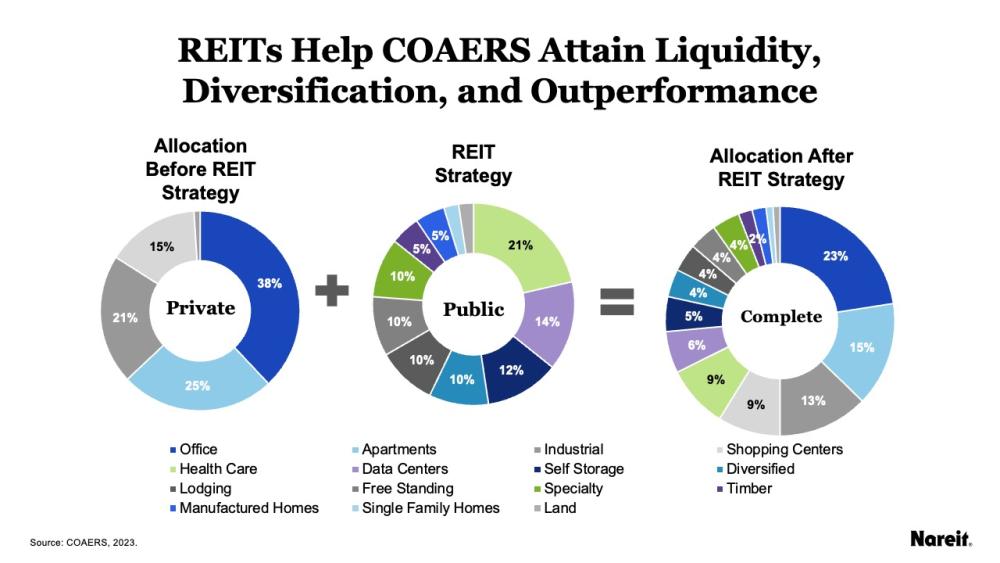

City of Austin Employees’ Retirement System (COAERS): In 2019, COAERS was using private real estate to gain access to the office, industrial, multifamily, and retail sectors, but the pension was missing exposure to sectors outside of those four property types. COAERS worked with FTSE and Nareit to create a completion index of REIT sectors that weren’t represented in the pension’s portfolio.

COAERS used REITs to complement its existing private real estate exposure—which successfully helped the fund increase exposure to property types that will likely see increased demand in the future—and achieve meaningful outperformance relative to the broad FTSE Nareit All Equity REITs Index.

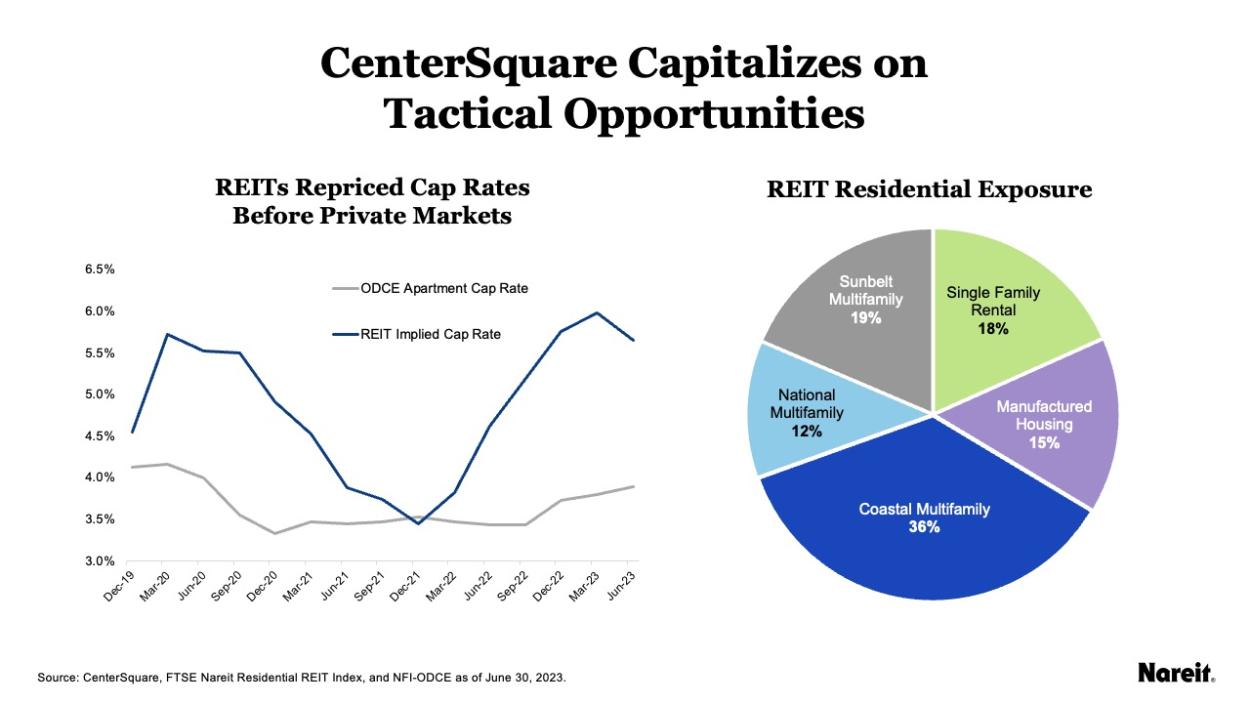

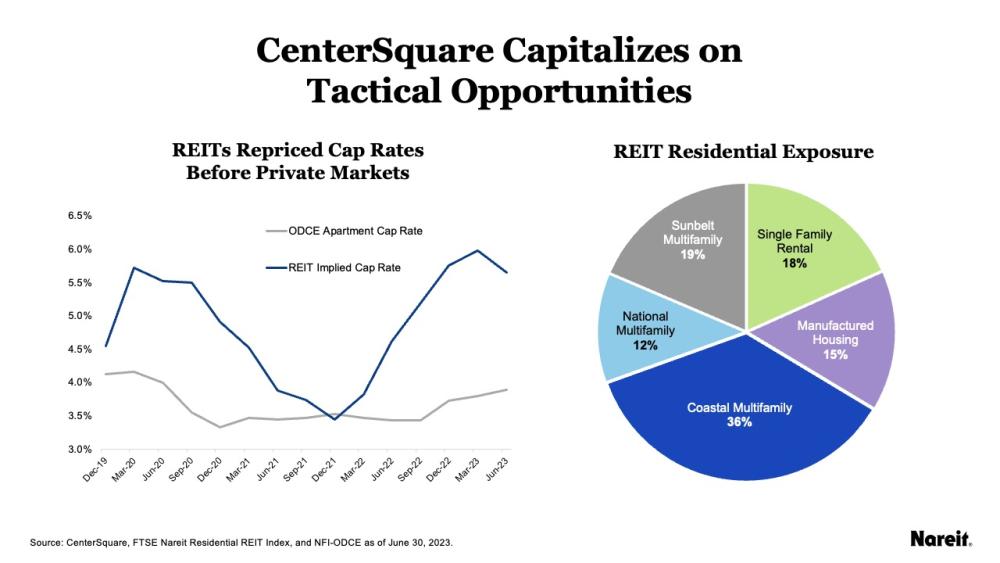

CenterSquare: Throughout 2022 and 2023, there has been a divergence between private and public real estate valuations. Investment management firm CenterSquare capitalized on this by adding a residential REIT sleeve into a client’s overall real estate allocation. This enabled CenterSquare to acquire exposure at attractive pricing due to the valuation gap between public and private real estate, while simultaneously addressing the client’s under-allocation to the residential sector.

CenterSquare executed its REIT strategy in mid-2022, when open end diversified core equity (ODCE) fund cap rates were still at 3.4%, but REITs had begun to reprice and were trading at a 4.6% implied cap rate. This move enabled CenterSquare to tactically take advantage of the valuation divergence, while completing the investor’s portfolio with exposure to a high-quality residential sector with best-in-class operating platforms.

The Future: Using REITs to Gain Access to Meet Sustainability Targets

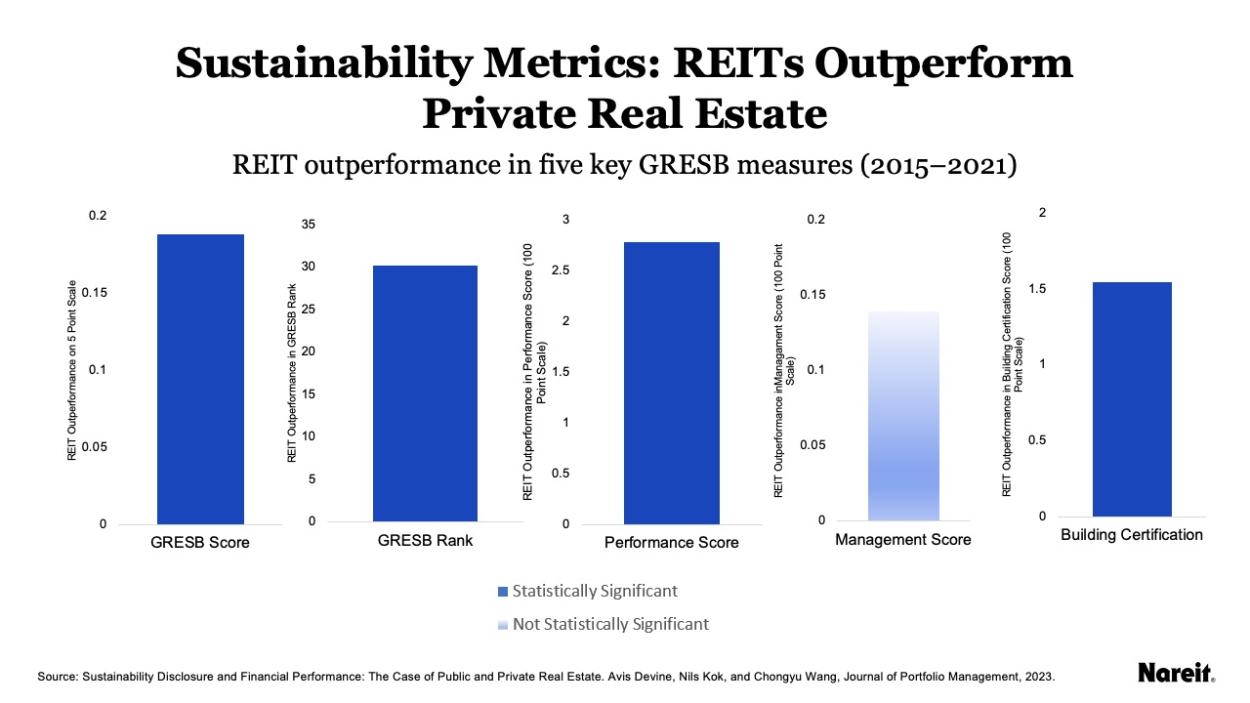

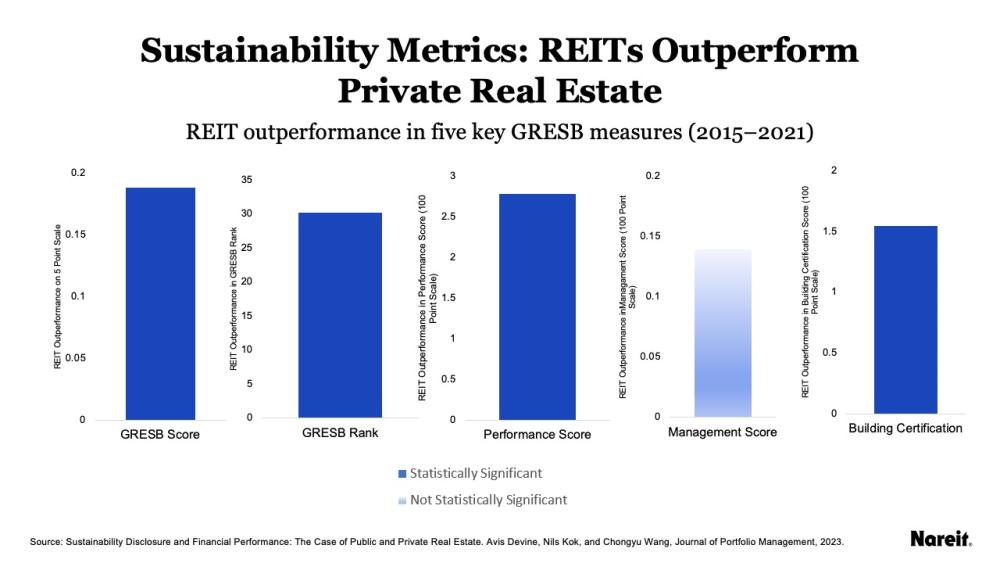

Some institutional investors have become increasingly focused on the sustainability of their investment portfolios, and data show that REITs provide access to some of the best-in-class sustainability performers. A Journal of Portfolio Management study underscores this by demonstrating that REITs outperform private real estate in key sustainability metrics.

As shown in the chart above, REITs statistically outperform private real estate in four specific GRESB sustainability measures.

Nearly two-thirds of the largest, most sophisticated investors use REITs. In 2024, more institutional investors are likely to use REITs to complement private real estate allocations and complete their portfolios, as investors increasingly recognize the tactical and strategic benefits that REITs offer.

David Sullivan is senior vice president of investment affairs at Nareit. He leads institutional pension plan, foundation, and endowment outreach for Nareit, which entails promoting and facilitating real estate investment through REITs to institutional investors and their consultants worldwide.