Latest Articles

Host Hotels & Resorts CFO Sees Multiple Tailwinds Supporting Sustained Growth in 2026

Retail REITs Benefiting from Strong Market Fundamentals, Tight Supply

Names to Note: February 2026

Quantum Computing Emerging as Next Demand Layer for Data Centers

Armada Hoffler Hits Reset to Focus on Retail, Office Portfolio

High Yields, Strong Returns: mREITs Were a Stand Out in 2025

Names to Note: January 2026

CRE Sustainability Priorities 2026: Webinar Recap

Looking to search all news?

With industry news, monthly market updates and more, we’ve got you covered for all things REIT. Search our extensive database to find interviews, blog posts, articles, videos and podcasts.

Market Commentary

View all Market CommentariesREIT Report Podcasts

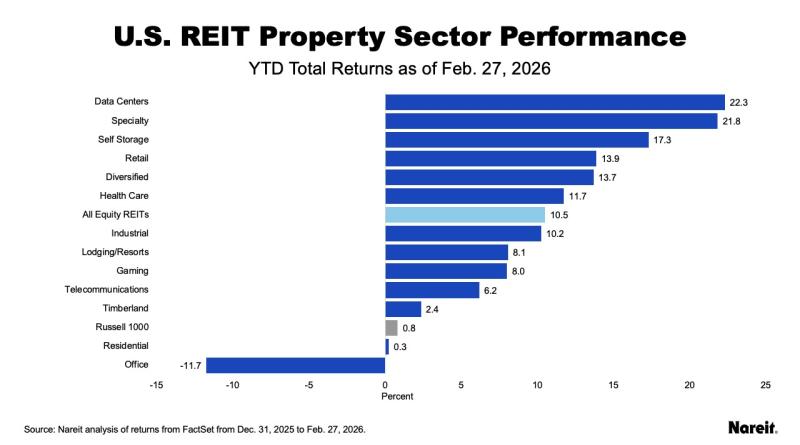

Green Street’s Michael Knott Says REITs Faring Well in 2026 Amid Market Cross Currents

REIT Investor & Author Jussi Askola on Sector’s Advantages Versus Private Real Estate

First Street’s Jeremy Porter Urges Holistic Approach to Assessing Climate Risk Impact

Citi Global Real Estate Team Sees Higher Returns, More Positive Supply Outlook in 2026

CBRE’s Henry Chin Expects Increased Capital Deployed in U.S. Real Estate

mREITs Operating in Healthy Risk-Return Environment: Green Street’s Harsh Hemnani

BREEAM Sees Growing Need for Data to Ensure Sustainability Performance Matches Investment Thesis

REITs Set for Growth Amid Favorable Supply, Rate Backdrop: AEW’s Gina Szymanski

Nareit Developments

View all Nareit DevelopmentsLatest Videos

Yardi Sees Client Shift Toward Fully Integrated Platforms for Better Data Accuracy

Vinson & Elkins Says REIT Deal Terms Increasingly Being Shaped by Pickup in M&A

AvalonBay Leans Into Development and Capital Flexibility Amid Shifting Demand

REITs Seeing Healthy Access to Debt Markets, Equity Issuance Lagging: Raymond James

DiamondRock Sees Strong Demand for Resort Travel Across Age Groups Amid Limited Supply

VICI Properties Sees Long-Term Growth in Experiential Real Estate

CoStar’s Ten-X Says Online Asset Auctions Drive Efficiency, Certainty, Competition